Biden's student loan plan and how this affects student loan forgiveness.

In a world where student loan debt appears like a relentless storm cloud over the heads of countless Americans, President Joe Biden's student loan plan has garnered attention for its potential to provide relief. As the weight of student loans continues to crush the aspirations of graduates nationwide, this plan promises a ray of light in the form of potential forgiveness. But what does it really mean for those struggling with student debt? Let's dive into the details of Biden's plan and its implications for student loan forgiveness in the United States.

The Supreme Court rejected President Joe Biden’s authority to give blanket forgiveness of the $10,000 to $20,000 of student debt for tens of millions of Americans. There have been many options the administration is considering, including refiling for the forgiveness but using the Higher Education Act instead of the Heroes Act. The Department of Education unveiled the final details of its separate student loan repayment program. The program, Saving on a Valuable Education (SAVE) Plan, which has been in the works for more than a year, will permanently reshape how borrowers repay their federal student loans.

What’s in the plan:

- Help low and moderate-income people. The program aims to help low and moderate-income people as many borrowers would face lower monthly payments, the department will curb interest accrual, and borrowers with relatively smaller balances could see loan forgiveness more quickly. They are still looking for pathways for middle-class working people, including saving on valuable education plans. It will lower the payment for those earning under $32,800 to $0.00 and less for those earning and having a family of four and earning up to $67,500.

- Change how much people pay and stop interest accrual. This program offers the benefit to change how much people pay and stop interest accrual. The core part of the Biden administration's plan is to lower the amount of borrowers' income that is used to pay back loans by changing what's called the discretionary income formula. The increase of the income threshold for zero-dollar payments from 150 percent of the poverty line to 225 percent of the poverty line, immediately lowering payments for lower-income borrowers. Borrowers won’t have to pay interest that accrues in a month beyond what’s covered by their monthly payment. This stops the growing accrual of interest on student loan payments. This means that if $100 of interest is accrued and a borrower’s payment is only $50, the other $50 from that $100 projected interest would automatically be forgiven as long as the borrower paid their payment on time.

- Not include spousal income for the purpose of repayment. The SAVE plan has a noteworthy feature regarding spousal income for repayment purposes. Specifically, if you are married and file your taxes separately, the SAVE program does not factor in your spouse's income when calculating your monthly payments. This means that there is no requirement for your spouse to co-sign your Income-Driven Repayment (IDR) application, and their income will not affect the calculation of your monthly payments. As a result, this provision often leads to reduced monthly payments, as your reported income remains unaffected by your spouse's financial situation.

- Repayment terms. What is viewed as a really big CON of the SAVE program is that payments are not capped and that the repayment length is 25 years. If somebody graduates with $12,000 and under, their repayment length is 10 years and it increases by 1 year per $1000.

How is this different from the similar program called Pay As you Earn (PAYE)?

For all those who might have not heard about it, PAYE is an existing federal student loan repayment program. It was introduced in 2012 by the U.S. Department of Education to provide relief to borrowers struggling with high student loan debt. PAYE is considered a more favorable alternative to IBR and is one of several income-driven repayment plans available to federal student loan borrowers and is designed to make loan repayment more manageable based on your income and family size.

The Main Difference:

- Payment Calculation: Your payment under SAVE will be less because the formula uses a higher threshold of income in order to make a payment.

- Length of Repayment: PAYE offers loan forgiveness after 240 qualifying payments (20) years regardless if you have an undergraduate or a graduate loan. Any remaining balance is forgiven after 20 years.

SAVE on the other hand would depend on the type of loan you borrowed. If you have an undergraduate loan, your repayment term is 240 qualifying payments (20 years) before you can access loan forgiveness, while it would increase to 300 qualifying payments (25 years) if you got a graduate loan. Any remaining balance is forgiven after

- CAPPED monthly payments: On PAYE, your required monthly payments are capped such that your payment would not go beyond what you would have paid on the Standard 10 year plan.

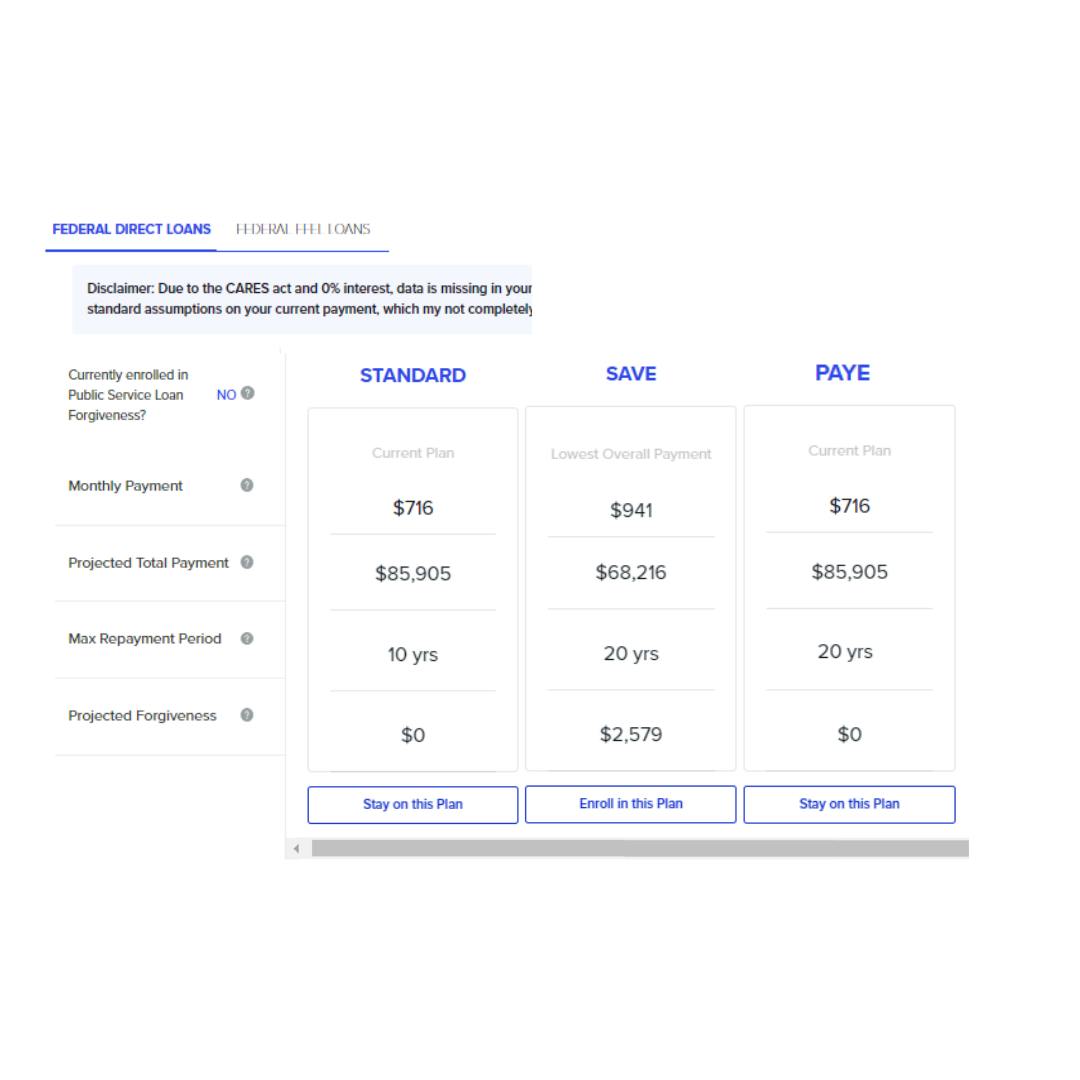

For example, for someone who earns $40,000 Annual Income and $73, 471 of student Loans, angle and with no dependents. Your required payment on a standard 10 yr plan would have to be $716. With PAYE, this amount of $716 will be the maximum payment you will have to make regardless of how much income you make. However, with SAVE, it goes over that amount depending on how much income you are making. Let’s say your income increases from $40,000 to $150,000 in the next 10 years. Now with SAVE, your payment would also increase to up to $941 but PAYE will cap at $716.

On SAVE there is no cap. Therefore, if your income increases significantly your monthly payments will as well.

These programs both aim to provide relief to borrowers, but SAVE offers potentially lower monthly payments and streamlined eligibility requirements for forgiveness. It's essential to assess your individual financial situation and loan terms to determine which program may be more suitable for you.

Should I enroll into the SAVE program given that it is potentially a better option?

The answer is a big MAYBE. While the SAVE program presents a viable option for borrowers to consider, primarily if you value a lower payment and do not have an income that will significantly increase over time. With no payment cap, SAVE can cost more monthly than PAYE if you are projecting a significant increase on your income from when you entered repayment.

Deciding whether to enroll in the SAVE program is a significant financial choice, and the best course of action depends on your unique circumstances. To make an informed decision, I recommend speaking with a qualified loan advisor who can provide personalized guidance tailored to your specific situation. They can assess your current loan terms, financial status, and goals to determine whether SAVE is indeed the optimal option for you.

When is the Program available?

Borrowers will be able to sign up this summer to allow the Education Department to automatically use their tax information to stay enrolled in the program each year; that option won’t be fully up and running until July of 2024, according to the department. But right now you may want to consult with us at LoanSense before you change your student loan plan, especially if you're going to buy a house because it can impact your debt to income.

Additionally, Revised Pay As You Earn, the way it currently accumulates interest and recognizes filing jointly and separately does impact you, especially if the SAVE plan is not launched ahead of the next tax filing season. We have a whole tool at myloansense.com that will help you understand what the right decision is for you even after the SAVE plan is launched.

Need help with what options are best for you? Get in touch with us. To connect with a loan advisor and schedule a consultation, please click here. You may also use our read more information about the SAVE program and other available resources about student loans by visiting the help section of our website at https://resources.myloansense.com

Exploring your student loan options is a vital step in achieving financial peace of mind. The SAVE program represents a valuable opportunity, but its effectiveness hinges on your individual circumstances. We invite you to dig deeper into this topic to gain a better understanding of how it can benefit you. To help you on this journey towards financial empowerment, we encourage you to connect with our knowledgeable loan advisors.

By scheduling a consultation, you'll unlock valuable insights that can help you make informed decisions about your student loans —Schedule Your Consultation today, and empower yourself with the knowledge needed to take control of your financial future! Your financial well-being starts with informed decisions.

Need help with what options are best for you? Get in touch with us.