Biden's Student Loan Program: Unlocking Homeownership Through IDR Adjustment

In October of 2023, the government’s pause on student loan payments officially ended and 9 million borrowers missed their first payment. In response to this alarming statistic and the growing financial challenges as a result of student loans, Joe Biden implemented a one-time Income-Driven Repayment (DR) account adjustment.

For mortgage and real estate professionals, the IDR adjustment can mean more business with millennial and gen z consumers struggling to enter the market. According to x, student loan debt is the leading barrier for millennials saving for a down payment. Additionally, the missed student loan payments underscore the urgency for measures to alleviate financial pressure on prospective homeowners, as high payments create a detrimental cycle of missed payments impacting credit scores and overall financial health.

Here is what the industry needs to know about the IDR adjustment and how it may impact their business.

Biden's IDR Adjustment: A Lifeline for Borrowers

The IDR adjustment offers significant relief by lowering monthly payments through income-driven plans, providing immediate financial breathing room.

Lowering Payments and Loan Forgiveness: A Dual Benefit

The IDR adjustment not only reduces monthly payments but also introduces the prospect of loan forgiveness. With outstanding student loan debt in the United States reaching $1.59 trillion in Q3 2022, this dual benefit addresses both immediate financial strain and offers a long-term solution for a more stable financial future.

IDR Plans and Government-Backed Loans

This adjustment positively affects borrowers seeking government-backed loans, including those facilitated by Freddie Mac, Fannie Mae, FHA, and VA. For instance, participating in an IDR plan improves a borrower's debt-to-income ratio, increasing eligibility for loans in the secondary mortgage market. Similarly, FHA and VA loans, known for their stringent eligibility criteria, can become more accessible with the proactive debt management demonstrated by an IDR plan.

Affording More Home:

Reduced monthly payments empower borrowers to allocate more income toward housing costs, making it easier to afford and maintain homes. With the median existing-home price at $367,500 in October 2022, lower mortgage payments increase purchasing power, stimulating the real estate market and fostering economic growth.

President Biden's one-time IDR account adjustment emerges as a beacon of hope for borrowers grappling with high mortgage payments. By addressing immediate financial concerns and offering the prospect of loan forgiveness, it paves the way for homeownership, with ripple effects contributing to economic growth and stability. As the mortgage industry navigates these challenging times, the IDR adjustment stands as a testament to the government's commitment to fostering financial resilience and homeownership for all. The positive impact on eligibility for government-backed loans further emphasizes the importance of IDR plans in making homeownership dreams a reality for a broader spectrum of borrowers.

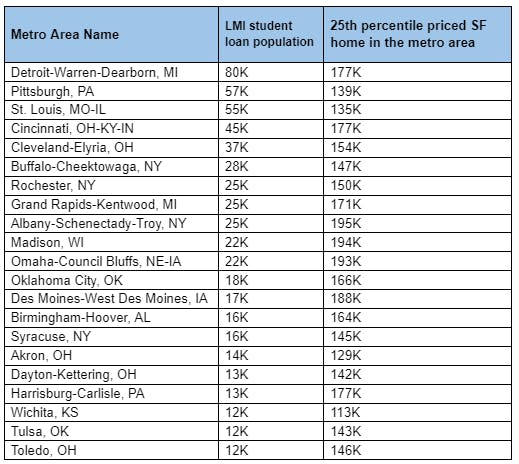

The following metropolitan markets have low to moderate income (LMI) borrowers with student loans and enough inventory in the 25th percentile home price that borrowers can actually afford. This data tells us that these markets are the prime target markets to assist low to moderate income borrowers afford more home. The data is ranked from largest LMI student loan borrowers population to the lowest by metropolitan area. These markets are include:

If you need personalized assistance or have questions about your specific situation, our experts at LoanSense are here to help. Visit our website at www.myloansense.com to learn more about our services and get in touch. You may also check out our YouTube Channel for more informative discussions and topics related to student loan debt.

Any inquiries can be made to hello@myloansense.com

Need help with what options are best for you? Get in touch with us.

Get the latest Student Loan Pro tips. We'll give you the best strategies and keep you up-to-date on loan programs. We keep our communications short and helpful. Sign up for our weekly protips now!