Why is Discretionary Income Important & How to calculate it?

Discretionary income is the formula used to determine how much your monthly student loan repayment will be.

This information is for the detailed people out there who are interested in how your student loan payment is calculated. We can feel your excitement!

Why do we have discretionary income? The government built income-driven plans to make sure everybody can afford their loans regardless of their income or the amount they owe.

How much you can afford is based on 10-20% of your discretionary income and the percentage depends on which plan you qualify for - PAYE, REPAYE, IBR or ICR.

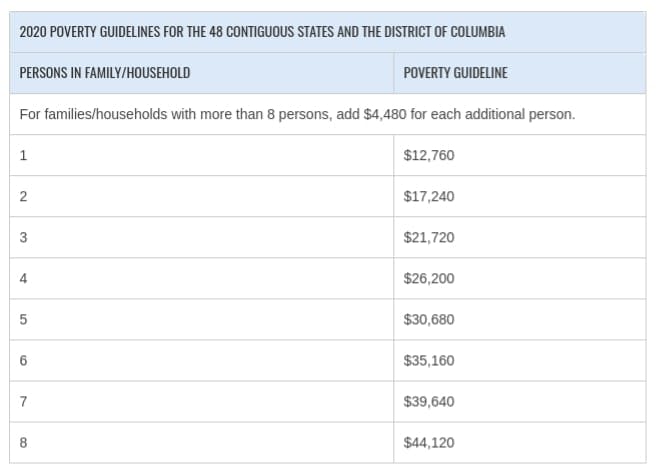

Calculate your discretionary income - The chart below is the 2020 Poverty Guidelines according to the US Department of Health and Human Services. The poverty line is based on your family size.

Step 1: Multiply the dollar amount based on your family size by 1.5. (Example - Your family has 4 people. That is $26,200. $26,200 x 1.5 = 39,300)

Step 2: Take the adjusted gross income or AGI from your prior tax return. Let’s say that is $60,000. This number is not your pre-tax salary. You would receive a standard deduction. Take $60,000 and subtract the number from step 1 $39,300. That is 20,700.

Step 3: If you are on PAYE or REPAYE, then 10% of this amount is your annual payment. If we continue the example above, it would be $2070 annually. Divided by 12 payments would make the payment $172.5 per month.

If you have any issues with your student loans, don't forget we're available to assist.

Get started now!